Proposed One-Quarter Cent Sales Tax

Current Sales Tax Rate

- Guilford County residents currently pay a combined state and local sales tax of 6.75%, meaning $6.75 on a $100 purchase.

- Sales tax is collected by retailers on taxable goods and services at stores and restaurants in Guilford County. The current sales tax rate in Guilford County is 6.75%. Of this amount, 4.75% is kept by the State of North Carolina and the remaining 2% is distributed back to Guilford County, local governments, and fire districts.

The 0.25% sales tax is authorized under Article 46 on transactions subject to the general rate of sales and use tax. All proceeds are distributed back solely to the County.

The North Carolina Department of Revenue has an explanation of each article of sales tax.

Proposed Increase

- The one-quarter cent (¼¢) sales tax increase would raise the combined sales tax to 7%, translating to $7.00 on a $100 purchase. (Compared to $6.75 on a $100 purchase today.)

- For a consumer, the increase would equate to 1 cent for every $4 spent.

County Resolution of Intent

By a Resolution it adopted on June 18, 2025, the Board of County Commissioners stated an intent to use proceeds from the 1/4 cent sales and use tax, if approved by the voters of Guilford County, for the purpose of increasing the County’s Local Supplement towards compensation for teachers and classified employees of Guilford County Schools. The Resolution, while non-binding, was adopted unanimously by the bi-partisan Board of County Commissioners.

Comparison with Surrounding Counties

- Statewide Context: In total, 46 counties across North Carolina have implemented a one-quarter cent sales tax.

- Rockingham, Forsyth, Randolph, and Davidson counties levy this additional sales tax; Stokes and Alamance County do not.

Additional information on the Local Option Sales Tax and the process/procedure a Board of County Commissioners must follow when considering an advisory referendum can be found on the North Carolina Association of County Commissioners website. View Frequently Asked Questions on local option sales tax.

Exemptions from Sales Tax Increase

The proposed sales tax increase would not apply to items such as:

- Prescriptions

- Motor Vehicles

- Certain Medical Equipment

- Gasoline

- Non-Prepared Food or Groceries

The North Carolina Department of Revenue provides information on which items are subject to sales and use tax. View more information on sales and use tax rates.

Revenue Generation

- The one-quarter cent (¼¢) sales tax could generate approximately $25 million annually for Guilford County.

- Property tax generates $7.2 million for each penny of the property tax rate. One-fourth of a penny in sales tax is projected to raise approximately $25 million annually.

- Sales taxes are generated from residents as well as tourists and visitors to Guilford County.

One-Quarter Cent Sales Tax Timeline

- June 18, 2025: The Board of County Commissioners adopt the resolution.

- Date 2: Timeline date 2 details

- Date 3: Timeline date 3 details

Frequently Asked Questions

This is placeholder text for the fund distribution information that will go here.

Each month, the North Carolina Department of Revenue releases a Sales and Use Tax Distribution report that shows revenue generated by article. View Sales and Use Tax Distribution reports.

The advisory referendum will be included on the November 2024 general election ballot. Learn more about voting in Guilford County.

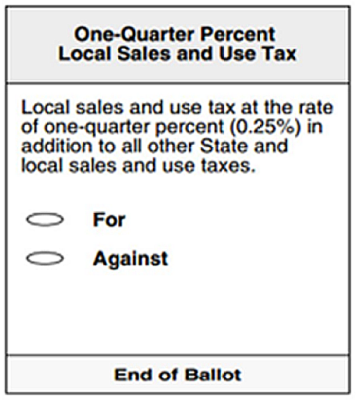

A “For” or “Against” vote advises the Board of County Commissioners on the proposed .25% addition to the local sales and use tax (i.e., 1/4 cent per dollar).

A vote “For” would allow the Board of County Commissioners to adopt the increase. An “Against” vote would reject it.

The Ballot

Please see the sample ballot below.